You have probably heard of Value Added Tax and know what it stands for. Let’s cover the basics.

What is VAT?

Value-Added Tax (VAT) is a tax, which is payable on sales of goods or services within the territory of the Member States of the EU.

The tax, in all cases, is ultimately payable by the final consumer of the good or service. Each party in the chain of supply (manufacturer, wholesaler and retailer) acts as a VAT collector.

Who needs to register for VAT?

Value-Added Tax (VAT) registration is obligatory when your turnover exceeds, or is likely to exceed, the VAT thresholds. The thresholds depend on your turnover in any continuous 12-month period.

In short, the main principal thresholds are as follows:

- €75,000 for persons supplying goods.

- €37,500 in the case of persons supplying services only

Traders whose turnover is below the VAT thresholds are not generally obliged to register for VAT. They may, however, elect to register for VAT.

If you have set up a business but have yet to supply taxable goods or services, you may reclaim VAT on your start-up costs. However, to do so you are required to register for VAT.

How to register for VAT?

You, or your tax agent, can register your business for Value-Added Tax (VAT) through Revenue Online Service (ROS). You need to submit a form with your business trading information and VAT accounting basis.

Once you’re registered for VAT

After registration, you need to:

- add VAT to your prices

- issue tax invoices to your customers

- keep receipts and invoices to claim back VAT on business expenses

- submit VAT Returns to the Revenue on every two-month period

How to add VAT on prices?

Generally, you need to put your prices up by 23% which is the standard VAT rate. There’s a very simple formula for doing that:

However, certain goods and services are liable to reduced rates or are exempt from VAT. Make sure to check what is applicable to your business.

What is a VAT invoice?

Now that you are VAT registered, you must issue a VAT invoice. The information given on a VAT invoice is the basis for establishing your VAT liability on the supply of goods or services. It also enables your VAT-registered customers to reclaim the VAT charged to them.

What needs to be on a VAT invoice?

Here is a short overview of what you need to put on a VAT invoice. You can find a full list here.

How to work out your VAT payment or refund?

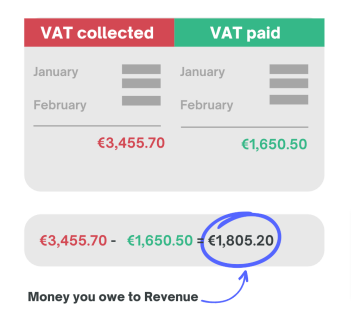

You need to keep track on the amount of VAT you collected on sales and compare it with the amount you paid on purchases.

Naturally, you’ll aim to sell more than you buy, which means that you’ll end up with a VAT bill to pay. The amount payable is a simple math, total VAT collected on your sales less VAT paid on your purchases.

The best way to work out how much VAT to pay is to use online accounting software such as Xero. It automatically records VAT collected and paid, and does the maths for you.